#certified asset management

Explore tagged Tumblr posts

Text

Welcome to the world of asset management, where financial expertise meets strategic planning to optimize investments and generate maximum returns. At World Partners in Asset Management, we pride ourselves on being the forefront of innovation, delivering top-notch services to our clients across the globe.

#cama#cama certification#global certification#wpiam#asset management certification#wpiam asset management#cama certification training#management certification#world partners in asset management#certified asset management#global certification scheme#gcs exam#about gcs

0 notes

Text

#Electronics Waste Disposal Near Me#Certified e waste Recyclers#ewaste recyclers in mumbai#Ewaste Buyer in Andheri#E-Waste Buyer in Bkc#E Waste Recyclers#Recyclers in Near#IT Asset Recycling#Best buy Ewaste#Waste recyclers#Near Recyclers#E Recycling#Recycling Management Companies#Free Recycle Electronics Near Me#How To Dispose of Electronics#Recycling Center Near Me#Ewaste Recyclers Near Me#Free Recycling Near Me#Ewaste Best recyclers#recyclers in mumbai#E Waste Recycling#Recyclers in Pune#E waste recycler#IT Asset recycler#Best recyclers

1 note

·

View note

Text

Understanding the Technical Asset Management (CCMTAM) Course: A Pathway to Excellence in Aircraft Asset Management

In the world of aviation, managing assets — particularly aircraft — is a multifaceted and challenging task that demands a deep understanding of both technical and financial aspects. As the aviation industry continues to grow, so does the complexity of managing aircraft fleets, making specialized training in Technical Asset Management (TAM) more important than ever. One such opportunity for mastering this vital skill is the Certified Course in Technical Asset Management (CCMTAM). This blog explores what this course offers, why it’s crucial for professionals in the aviation sector, and how it equips individuals with the knowledge to enhance asset management processes.

What is the CCMTAM Course?

The Certified Course in Technical Asset Management (CCMTAM) is designed for professionals in the aviation industry who are involved in the management, acquisition, and maintenance of aircraft assets. This comprehensive program is offered to individuals in various roles, including those in aircraft leasing, aviation finance, technical management, and operational oversight.

Key Learning Areas in the CCMTAM Course

The CCMTAM course covers a wide range of topics that are critical to effective asset management in aviation. Some of the key learning areas include:

1. Aircraft Acquisition and Disposition

One of the most important elements of asset management is knowing when and how to acquire and dispose of aircraft. The CCMTAM course teaches the technical and financial considerations involved in these processes, covering topics such as aircraft evaluation, market trends, and lease agreements.

2. Aircraft Maintenance and Life Cycle Management

Aircraft are highly complex machines that require regular maintenance to ensure safety and performance. The course provides in-depth knowledge on maintenance planning, ensuring that participants understand how to schedule and manage maintenance activities for maximum efficiency. The lifecycle management aspect focuses on managing the aircraft through its various phases — from acquisition to retirement — ensuring it remains operationally viable throughout its lifespan.

3. Regulatory and Compliance Requirements

Aviation is one of the most regulated industries globally, with strict adherence to standards mandated by governing bodies such as the FAA (Federal Aviation Administration) and EASA (European Union Aviation Safety Agency). The course covers the necessary regulatory frameworks and ensures that participants understand compliance requirements for aircraft operations, maintenance, and fleet management.

4. Aircraft Valuation and Financial Considerations

Understanding the financial value of an asset is crucial in asset management. The CCMTAM course explores the principles of aircraft valuation, including factors like market demand, depreciation, and residual value. Participants will also gain insight into the financial aspects of aircraft leasing, financing options, and risk management, all of which are necessary for making informed decisions regarding fleet investments.

5. Risk Management

Managing risk is essential in the aviation industry, particularly when it comes to asset management. The course emphasizes strategies for identifying, assessing, and mitigating risks associated with aircraft ownership and leasing. By understanding how to manage operational, financial, and regulatory risks, professionals can minimize potential losses and ensure the longevity of their assets.

6. Data-Driven Decision Making

Modern asset management is increasingly reliant on data analytics to make informed decisions. The CCMTAM course emphasizes the use of data in managing aircraft assets. By utilizing key performance indicators (KPIs) and other metrics, participants learn how to track the performance of their assets and optimize their fleet management strategies.

Why Take the CCMTAM Course?

As the aviation industry becomes more dynamic, professionals involved in aircraft asset management need to keep up with emerging trends, technologies, and best practices. The CCMTAM course is ideal for individuals who are looking to advance their careers and gain a competitive edge in the industry. Here are some reasons why this certification is essential:

1. Industry Recognition and Credibility

Completing the CCMTAM course provides professionals with a globally recognized certification that adds credibility to their expertise. This certification demonstrates to employers, clients, and partners that the individual possesses the necessary skills to manage aircraft assets effectively and efficiently.

2. Enhanced Career Opportunities

The demand for highly skilled asset managers is on the rise in aviation. By obtaining a certification like CCMTAM, professionals position themselves as leaders in the field, opening doors to higher-paying roles and career advancement opportunities within the aviation industry.

3. Comprehensive Skill Set

The CCMTAM course equips participants with a broad skill set, ranging from technical knowledge of aircraft maintenance to financial acumen in asset valuation and management. This holistic approach ensures that participants are well-prepared to handle the complexities of managing aviation assets.

4. Networking Opportunities

Participants in the CCMTAM course often have the opportunity to network with industry professionals, including instructors, peers, and guest speakers. These connections can lead to collaborations, job opportunities, and valuable industry insights that can enhance one’s professional growth.

Conclusion

The Certified Course in Technical Asset Management (CCMTAM) is a vital resource for aviation professionals looking to excel in the asset management field. With its comprehensive curriculum covering key topics like aircraft acquisition, maintenance, regulatory compliance, risk management, and financial considerations, the course provides participants with the knowledge and tools to succeed in managing complex aviation assets. As the aviation industry continues to evolve, the importance of technical asset management cannot be overstated. Professionals who invest in this certification will not only gain valuable skills but also open up a wealth of career opportunities in one of the world’s most dynamic and critical industries.

0 notes

Text

#hospitality asset management software#hotel asset management software#hospitality asset management#certified hotel asset manager

0 notes

Text

Secure Computer Recycling and Data Destruction Solutions in Dubai

Recycle old computers and IT equipment with confidence through our secure recycling and data destruction services. Designed to prevent data breaches, our certified hard drive destruction service ensures sensitive data is removed before disposal. Promote sustainability and protect your business's information with our eco-friendly e-waste solutions in Dubai. Choose Recycle Emirates for safe and compliant computer recycling services. For more information visit: https://recycleemirates.com/

#recycling companies dubai#e waste recycling in dubai#computers recycling services dubai#electronics recycling dubai#certified data destruction dubai#hard drive destruction service#recycle old it equipment#it asset recovery services#e waste management dubai#data destruction company dubai

0 notes

Text

Cryptocurrency Investment Approach

DAIM presents a new approach to cryptocurrency investment, providing advanced solutions to help investors navigate the digital asset landscape. Stay updated on market trends and discover innovative strategies to optimize your crypto portfolio. Join us on our platform for expert insights and a proactive approach to cryptocurrency investment. Start your path towards financial growth and success in the world of digital currencies with DAIM.

#Cryptocurrency Investment#digital asset management#crypto roth ira#crypto advisor#certified crypto advisor#licensed crypto advisor

0 notes

Text

Lease Management | Property Asset Tech Solutions| Lease Admin

Looking for expert lease management solutions? Lease Admin Consulting Inc. offers comprehensive services tailored to streamline your lease processes. From lease abstraction to compliance management, our experienced team ensures efficiency and accuracy every step of the way. Trust us for reliable lease management solutions that optimize your operations and maximize your returns.

#Lease Management#Property Asset Tech Solutions#Lease Admin#Certified Accountants Tech Solutions#Mri Tech Solutions

1 note

·

View note

Text

As cloud computing continues to transform businesses, cloud asset management has become an essential skillset. The GSDC Certified Cloud Asset Management certification validates expertise in managing cloud assets efficiently. By getting certified in cloud asset management by GSDC, professionals demonstrate they have the required knowledge of cloud asset management best practices. The certification exam covers topics like cloud governance, cost optimization, security, and compliance.

Achieving GSDC's cloud asset management certification designates technologists as certified cloud asset managers. With the rise of multi-cloud environments, certified cloud asset managers who understand consolidating and governing cloud assets are in high demand.

Earning the GSDC cloud asset management certification shows commitment to effectively overseeing cloud platforms and resources. As cloud asset management grows more complex, the certified cloud asset management credential highlights technologists dedicated to optimizing cloud assets.

#cloud asset management#cloud asset management certification#cloud asset management certificate#certified cloud asset management

0 notes

Text

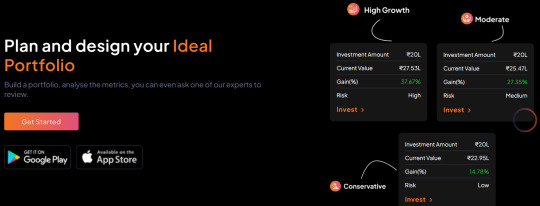

Portfolio Designer – A Unique Strategy to Build & Customise Your Portfolio | Sigfyn

An exclusive approach for an ideal mutual fund portfolio that suits your financial needs powered by algorithms. Enhance returns and manage risk by diversifying investments across different asset classes.

#portfolio designer#portfolio management#Certified Investment Planner#Asset Allocation#Risk Management#Investment Planning#Portfolio Insights#Mutual Fund Portfolio#Mutual Funds Schemes#Investment Advisors#Best HDFC Mutual Funds#HDFC Mutual Funds Online#SIP Investment Services#HDFC MF#Financial Advisory Services#Financial Planning Company#Sigfyn

0 notes

Text

A Certified Maintenance and Reliability Professional (CMRP) is an expert in maintenance and reliability management who has obtained certification through a recognized professional organization. CMRP professionals develop and implement strategies to improve equipment reliability and performance, reduce downtime, and optimize maintenance activities, resulting in increased efficiency and productivity. For more details about Certified Maintenance and Reliability Professional kindly visit our.

0 notes

Text

World Partners in Asset Management: Leading the Global Financial Landscape

Introduction

Welcome to the world of asset management, where financial expertise meets strategic planning to optimize investments and generate maximum returns. At World Partners in Asset Management, we pride ourselves on being the forefront of innovation, delivering top-notch services to our clients across the globe. In this article, we delve into the core principles that set us apart and make us the go-to destination for astute investors seeking growth and prosperity.

Our Vision and Mission

At World Partners in Asset Management, our vision is to revolutionize the financial landscape by providing unparalleled asset management solutions that consistently outperform market expectations. We aim to empower our clients with the tools and insights needed to navigate the complexities of the financial world with confidence and ease.

Our mission is to foster long-term partnerships with our clients, understanding their unique financial goals and tailoring personalized investment strategies to achieve them. We believe in transparency, integrity, and a client-centric approach that ensures their success is at the heart of everything we do.

A Dedicated Team of Experts

Behind our success story is a team of passionate and highly skilled professionals who bring diverse expertise to the table. Our portfolio managers, financial analysts, and research specialists work in tandem to identify lucrative investment opportunities, manage risk effectively, and adapt to ever-changing market conditions.

We take great pride in nurturing a work culture that fosters continuous learning and encourages our team to stay ahead of the curve. This approach enables us to make informed decisions and anticipate market trends, thus giving our clients a competitive edge.

Unparalleled Investment Strategies

In today's fast-paced financial environment, having a well-crafted investment strategy is paramount. At World Partners in Asset Management, our investment strategies are tailored to suit the unique risk profiles and objectives of our clients. We believe in a diversified approach that spreads investments across various asset classes, such as equities, fixed income, real estate, and alternative investments.

By blending in-depth market research, data analysis, and our team's expertise, we create investment portfolios designed to weather economic storms while seizing opportunities for growth. Our commitment to rigorous risk management ensures that our clients' assets are protected while seeking attractive returns.

Cutting-Edge Technology and Data Analytics

In the digital age, staying ahead requires embracing cutting-edge technology and data analytics. At World Partners in Asset Management, we leverage the power of advanced data-driven tools to gain valuable insights into market trends and investment opportunities.

Our technology-driven approach allows us to make informed decisions swiftly, ensuring that our clients' investments are optimized and aligned with their financial objectives. By harnessing the potential of artificial intelligence and machine learning, we continuously enhance our strategies to stay at the forefront of the asset management industry.

Client-Centric Approach

At World Partners in Asset Management, our clients are at the heart of everything we do. We take the time to understand their financial aspirations, risk tolerance, and investment horizons. By forging strong relationships built on trust and communication, we provide personalized solutions that evolve with our clients' changing needs.

Our client-centric approach extends beyond the investment process. We keep our clients informed about market developments, performance updates, and potential opportunities. Regular meetings and transparent reporting foster a sense of partnership, making us the trusted advisors our clients rely on.

Commitment to Ethical Practices

Ethics and integrity form the cornerstone of our business philosophy. We are committed to adhering to the highest standards of professionalism, transparency, and compliance. Our ethical practices ensure that our clients' interests always come first, and we maintain complete confidentiality regarding sensitive financial information.

Global Reach and Local Expertise

World Partners in Asset Management boasts a global presence with local expertise. Our network of offices spans across key financial hubs worldwide, enabling us to access a vast array of investment opportunities. While we operate on a global scale, we understand the significance of localized insights. Our teams possess a deep understanding of regional markets, regulatory environments, and cultural nuances, providing a competitive advantage to our clients.

Conclusion

In conclusion, World Partners in Asset Management is not just a name; it's a commitment to excellence, innovation, and the success of our clients. Our team of experts, client-centric approach, cutting-edge technology, and ethical practices combine to make us a formidable force in the asset management landscape.

If you are ready to embark on a journey of financial growth and prosperity, we invite you to partner with World Partners in Asset Management. Let us help you navigate the complex world of finance and unlock the potential of your investments.

Also Read: Unlock Professional Excellence with WPiAM Assessor Training Program

#world partners in asset management#certified asset management#global certification scheme#gcs exam#about gcs#cama#cama certification#global certification#wpiam#asset management certification#wpiam asset management#cama certification training#management certification

0 notes

Text

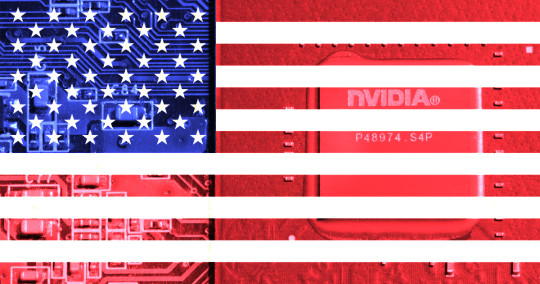

The CHIPS Act treats the symptoms, but not the causes

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/02/07/farewell-mr-chips/#we-used-to-make-things

There's this great throwaway line in 1992's Sneakers, where Dan Aykroyd, playing a conspiracy-addled hacker/con-man, is feverishly telling Sydney Poitier (playing an ex-CIA spook) about a 1958 meeting Eisenhower had with aliens where Ike said, "hey, look, give us your technology, and we'll give you all the cow lips you want."

Poitier dismisses Aykroyd ("Don't listen to this man. He's certifiable"). We're meant to be on Poitier's side here, but I've always harbored some sympathy for Aykroyd in this scene.

That's because I often hear echoes of Aykroyd's theory in my own explanations of the esoteric bargains and plots that produced the world we're living in today. Of course, in my world, it's not presidents bargaining for alien technology in exchange for cow-lips – it's the world's wealthy nations bargaining to drop trade restrictions on the Global South in exchange for IP laws.

These bargains – which started as a series of bilateral and then multilateral agreements like NAFTA, and culminated in the WTO agreement of 1999 – were the most important step in the reordering of the world's economy around rent-extraction, cheap labor exploitation, and a brittle supply chain that is increasingly endangered by the polycrisis of climate and its handmaidens, like zoonotic plagues, water wars, and mass refugee migration.

Prior to the advent of "free trade," the world's rich countries fashioned debt into a whip-hand over poor, post-colonial nations. These countries had been bankrupted by their previous colonial owners, and the price of their freedom was punishing debts to the IMF and other rich-world institutions in exchange for loans to help these countries "develop."

Like all poor debtors, these countries were said to have gotten into their predicament through moral failure – they'd "lived beyond their means."

(When rich people get into debt, bankruptcy steps in to give them space to "restructure" according to their own plans. When poor people get into debt, bankruptcy strips them of nearly everything that might help them recover, brands them with a permanent scarlet letter, and subjects them to humiliating micro-management whose explicit message is that they are not competent to manage their own affairs):

https://pluralistic.net/2021/08/07/hr-4193/#shoppers-choice

So the poor debtor nations were ordered to "deregulate." They had to sell off their state assets, run their central banks according to the dictates of rich-world finance authorities, and reorient their production around supplying raw materials to rich countries, who would process these materials into finished goods for export back to the poor world.

Naturally, poor countries were not allowed to erect "trade barriers" that might erode the capacity of this North-South transfer of high-margin goods, but this was not the era of free trade. It wasn't the free trade era because, while the North-South transfer was largely unrestricted, the South-North transfer was subject to tight regulation in the rich world.

In other words, poor countries were expected to export, say, raw ore to the USA and reimport high-tech goods, with low tariffs in both directions. But if a poor country processed that ore domestically and made its own finished goods, the US would block those goods at the border, slapping them with high tariffs that made them more expensive than Made-in-the-USA equivalents.

The argument for this unidirectional trade was that the US – and other rich countries – had a strategic need to maintain their manufacturing industries as a hedge against future geopolitical events (war, but also pandemics, extreme weather) that might leave the rich world unable to provide for itself. This rationale had a key advantage: it was true.

A country that manages its own central bank can create as much of its own currency as it wants, and use that money to buy anything for sale in its own currency.

This may not be crucial while global markets are operating to the country's advantage (say, while the rest of the world is "willingly" pricing its raw materials in your country's currency), but when things go wrong – war, plague, weather – a country that can't make things is at the rest of the world's mercy.

If you had to choose between being a poor post-colonial nation that couldn't supply its own technological needs except by exporting raw materials to rich countries, and being a rich country that had both domestic manufacturing capacity and a steady supply of other countries' raw materials, you would choose the second, every time.

What's not to like?

Here's what.

The problem – from the perspective of America's ultra-wealthy – was that this arrangement gave the US workforce a lot of power. As US workers unionized, they were able to extract direct concessions from their employers through collective bargaining, and they could effectively lobby for universal worker protections, including a robust welfare state – in both state and federal legislatures. The US was better off as a whole, but the richest ten percent were much poorer than they could be if only they could smash worker power.

That's where free trade comes in. Notwithstanding racist nonsense about "primitive" countries, there's no intrinsic defect that stops the global south from doing high-tech manufacturing. If the rich world's corporate leaders were given free rein to sideline America's national security in favor of their own profits, they could certainly engineer the circumstances whereby poor countries would build sophisticated factories to replace the manufacturing facilities that sat behind the north's high tariff walls.

These poor-country factories could produce goods ever bit as valuable as the rich world's shops, but without the labor, environmental and financial regulations that constrained their owners' profits. They slavered for a business environment that let them kill workers; poison the air, land and water; and cheat the tax authorities with impunity.

For this plan to work, the wealthy needed to engineer changes in both the rich world and the poor world. Obviously, they would have to get rid of the rich world's tariff walls, which made it impossible to competitively import goods made in the global south, no matter how cheaply they were made.

But free trade wasn't just about deregulation in the north – it also required a whole slew of new, extremely onerous regulations in the global south. Corporations that relocated their manufacturing to poor – but nominally sovereign – countries needed to be sure that those countries wouldn't try to replicate the American plan of becoming actually sovereign, by exerting control over the means of production within their borders.

Recall that the American Revolution was inspired in large part by fury over the requirement to ship raw materials back to Mother England and then buy them back at huge markups after they'd been processed by English workers, to the enrichment of English aristocrats. Post-colonial America created new regulations (tariffs on goods from England), and – crucially – they also deregulated.

Specifically, post-revolutionary America abolished copyrights and patents for English persons and firms. That way, American manufacturers could produce sophisticated finished goods without paying rent to England's wealthy making those goods cheaper for American buyers, and American publishers could subsidize their editions of American authors' books by publishing English authors on the cheap, without the obligation to share profits with English publishers or English writers.

The surplus produced by ignoring the patents and copyrights of the English was divided (unequally) among American capitalists, workers, and shoppers. Wealthy Americans got richer, even as they paid their workers more and charged less for their products. This incubated a made-in-the-USA edition of the industrial revolution. It was so successful that the rest of the world – especially England – began importing American goods and literature, and then American publishers and manufacturers started to lean on their government to "respect" English claims, in order to secure bilateral protections for their inventions and books in English markets.

This was good for America, but it was terrible for English manufacturers. The US – a primitive, agricultural society – "stole" their inventions until they gained so much manufacturing capacity that the English public started to prefer American goods to English ones.

This was the thing that rich-world industrialists feared about free trade. Once you build your high-tech factories in the global south, what's to stop those people from simply copying your plans – or worse, seizing your factories! – and competing with you on a global scale? Some of these countries had nominally socialist governments that claimed to explicitly elevate the public good over the interests of the wealthy. And all of these countries had the same sprinkling of sociopaths who'd gladly see a million children maimed or the land poisoned for a buck – and these "entrepreneurs" had unbeatable advantages with their countries' political classes.

For globalization to work, it wasn't enough to deregulate the rich world – capitalists also had to regulate the poor world. Specifically, they had to get the poor world to adopt "IP" laws that would force them to willingly pay rent on things they could get for free: patents and other IP, even though it was in the short-term, medium-term, and long-term interests of both the nation and its politicians and its businesspeople.

Thus, the bargain that makes me sympathetic to Dan Aykroyd: not cow lips for alien tech; but free trade for IP law. When the WTO was steaming towards passage in the late 1990s, there was (rightly) a lot of emphasis on its deregulatory provisions: weakening of labor, environmental and financial laws in the poor world, and of tariffs in the rich world.

But in hindsight, we all kind of missed the main event: the TRIPS (Agreement on Trade-Related Aspects of Intellectual Property Rights). This actually started before the WTO treaty (it was part of the GATT, a predecessor to the WTO), but the WTO spread it to countries all over the world. Under the TRIPS, poor countries are required to honor the IP claims of rich countries, on pain of global sanction.

That was the plan: instead of paying American workers to make Apple computers, say, Apple could export the "IP" for Macs and iPhones to countries like China, and these countries would produce Apple products that were "designed in California, assembled in China." China would allow Apple to treat Chinese workers so badly that they routinely committed suicide, and would lock up or kill workers who tried to unionize. China would accept vast shipments of immortal, toxic e-waste. And China wouldn't let its entrepreneurs copy Apple's designs, be they software, schematics or trademarks.

Apple isn't the only company that pursued this strategy, but no company has executed it as successfully. It's not for nothing that Steve Jobs's hand-picked successor was Tim Cook, who oversaw the transfer of even the most exacting elements of Apple manufacturing to Chinese facilities, striking bargains with contractors like Foxconn that guaranteed that workers would be heavily – lethally! – surveilled and controlled to prevent the twin horrors of unionization and leaks.

For the first two decades of the WTO era, the most obvious problems with this arrangement was wage erosion (for American workers) and leakage (for the rich). China's "socialist" government was only too happy to help Foxconn imprison workers who demanded better wages and working conditions, but they were far more relaxed about knockoffs, be they fake iPods sold in market stalls or US trade secrets working their way into Huawei products.

These were problems for the American aristocracy, whose investments depended on China disciplining both Chinese workers and Chinese businesses. For the American people, leakage was a nothingburger. Apple's profits weren't shared with its workforce beyond the relatively small number of tech workers at its headquarters. The vast majority of Apple employees, who flogged iPhones and scrubbed the tilework in gleaming white stores across the nation, would get the same minimal (or even minimum) wage no matter how profitable Apple grew.

It wasn't until the pandemic that the other shoe dropped for the American public. The WTO arrangement – cow lips for alien technology – had produced a global system brittle supply chains composed entirely of weakest links. A pandemic, a war, a ship stuck in the Suez Canal or Houthi paramilitaries can cripple the entire system, perhaps indefinitely.

For two decades, we fought over globalization's effect on wages. We let our corporate masters trick us into thinking that China's "cheating" on IP was a problem for the average person. But the implications of globalization for American sovereignty and security were banished to the xenophobic right fringe, where they were mixed into the froth of Cold War 2.0 nonsense. The pandemic changed that, creating a coalition that is motivated by a complex and contradictory stew of racism, environmentalism, xenophobia, labor advocacy, patriotism, pragmatism, fear and hope.

Out of that stew emerged a new American political tendency, mostly associated with Bidenomics, but also claimed in various guises by the American right, through its America First wing. That tendency's most visible artifact is the CHIPS Act, through which the US government proposes to use policy and subsidies to bring high-tech manufacturing back to America's shores.

This week, the American Economic Liberties Project published "Reshoring and Restoring: CHIPS Implementation for a Competitive Semiconductor Industry," a fascinating, beautifully researched and detailed analysis of the CHIPS Act and the global high-tech manufacturing market, written by Todd Achilles, Erik Peinert and Daniel Rangel:

https://www.economicliberties.us/our-work/reshoring-and-restoring-chips-implementation-for-a-competitive-semiconductor-industry/#

Crucially, the report lays out the role that the weakening of antitrust, the dismantling of tariffs and the strengthening of IP played in the history of the current moment. The failure to enforce antitrust law allowed for monopolization at every stage of the semiconductor industry's supply-chain. The strengthening of IP and the weakening of tariffs encouraged the resulting monopolies to chase cheap labor overseas, confident that the US government would punish host countries that allowed their domestic entrepreneurs to use American designs without permission.

The result is a financialized, "capital light" semiconductor industry that has put all its eggs in one basket. For the most advanced chips ("leading-edge logic"), production works like this: American firms design a chip and send the design to Taiwan where TSMC foundry turns it into a chip. The chip is then shipped to one of a small number of companies in the poor world where they are assembled, packaged and tested (AMP) and sent to China to be integrated into a product.

Obsolete foundries get a second life in the commodity chip ("mature-node chips") market – these are the cheap chips that are shoveled into our cars and appliances and industrial systems.

Both of these systems are fundamentally broken. The advanced, "leading-edge" chips rely on geopolitically uncertain, heavily concentrated foundries. These foundries can be fully captured by their customers – as when Apple prepurchases the entire production capacity of the most advanced chips, denying both domestic and offshore competitors access to the newest computation.

Meanwhile, the less powerful, "mature node" chips command minuscule margins, and are often dumped into the market below cost, thanks to subsidies from countries hoping to protect their corner of the high-tech sector. This makes investment in low-power chips uncertain, leading to wild swings in cost, quality and availability of these workhorse chips.

The leading-edge chipmakers – Nvidia, Broadcom, Qualcomm, AMD, etc – have fully captured their markets. They like the status quo, and the CHIPS Act won't convince them to invest in onshore production. Why would they?

2022 was Broadcom's best year ever, not in spite of its supply-chain problems, but because of them. Those problems let Broadcom raise prices for a captive audience of customers, who the company strong-armed into exclusivity deals that ensured they had nowhere to turn. Qualcomm also profited handsomely from shortages, because its customers end up paying Qualcomm no matter where they buy, thanks to Qualcomm ensuring that its patents are integrated into global 4G and 5G standards.

That means that all standards-conforming products generate royalties for Qualcomm, and it also means that Qualcomm can decide which companies are allowed to compete with it, and which ones will be denied licenses to its patents. Both companies are under orders from the FTC to cut this out, and both companies ignore the FTC.

The brittleness of mature-node and leading-edge chips is not inevitable. Advanced memory chips (DRAM) roughly comparable in complexity to leading-edge chips, while analog-to-digital chips are as easily commodified as mature-node chips, and yet each has a robust and competitive supply chain, with both onshore and offshore producers. In contrast with leading-edge manufacturers (who have been visibly indifferent to the CHIPS incentives), memory chip manufacturers responded to the CHIPS Act by committing hundreds of billions of dollars to new on-shore production facilities.

Intel is a curious case: in a world of fabless leading-edge manufacturers, Intel stands out for making its own chips. But Intel is in a lot of trouble. Its advanced manufacturing plans keep foundering on cost overruns and delays. The company keeps losing money. But until recently, its management kept handing its shareholders billions in dividends and buybacks – a sign that Intel bosses assume that the US public will bail out its "national champion." It's not clear whether the CHIPS Act can save Intel, or whether financialization will continue to hollow out a once-dominant pioneer.

The CHIPS Act won't undo the concentration – and financialization – of the semiconductor industry. The industry has been awash in cheap money since the 2008 bailouts, and in just the past five years, US semiconductor monopolists have paid out $239b to shareholders in buybacks and dividends, enough to fund the CHIPS Act five times over. If you include Apple in that figure, the amount US corporations spent on shareholder returns instead of investing in capacity rises to $698b. Apple doesn't want a competitive market for chips. If Apple builds its own foundry, that just frees up capacity at TSMC that its competitors can use to improve their products.

The report has an enormous amount of accessible, well-organized detail on these markets, and it makes a set of key recommendations for improving the CHIPS Act and passing related legislation to ensure that the US can once again make its own microchips. These run a gamut from funding four new onshore foundries to requiring companies receiving CHIPS Act money to "dual-source" their foundries. They call for NIST and the CPO to ensure open licensing of key patents, and for aggressive policing of anti-dumping rules for cheap chips. They also seek a new law creating an "American Semiconductor Supply Chain Resiliency Fee" – a tariff on chips made offshore.

Fundamentally, these recommendations seek to end the outsourcing made possible by restrictive IP regimes, to undercut Wall Street's power to demand savings from offshoring, and to smash the market power of companies like Apple that make the brittleness of chip manufacturing into a feature, rather than a bug. This would include a return to previous antitrust rules, which limited companies' ability to leverage patents into standards, and to previous IP rules, which limited exclusive rights chip topography and design ("mask rights").

All of this will is likely to remove the constraints that stop poor countries from doing to America the same things that postcolonial America did to England – that is, it will usher in an era in which lots of countries make their own chips and other high-tech goods without paying rent to American companies. This is good! It's good for poor countries, who will have more autonomy to control their own technical destiny. It's also good for the world, creating resiliency in the high-tech manufacturing sector that we'll need as the polycrisis overwhelms various places with fire and flood and disease and war. Electrifying, solarizing and adapting the world for climate resilience is fundamentally incompatible with a brittle, highly concentrated tech sector.

Pluralizing high-tech production will make America less vulnerable to the gamesmanship of other countries – and it will also make the rest of the world less vulnerable to American bullying. As Henry Farrell and Abraham Newman describe so beautifully in their 2023 book Underground Empire, the American political establishment is keenly aware of how its chokepoints over global finance and manufacturing can be leveraged to advantage the US at the rest of the world's expense:

https://pluralistic.net/2023/10/10/weaponized-interdependence/#the-other-swifties

Look, I know that Eisenhower didn't trade cow-lips for alien technology – but our political and commercial elites really did trade national resiliency away for IP laws, and it's a bargain that screwed everyone, except the one percenters whose power and wealth have metastasized into a deadly cancer that threatens the country and the planet.

Image: Mickael Courtiade (modified) https://www.flickr.com/photos/197739384@N07/52703936652/

CC BY 2.0 https://creativecommons.org/licenses/by/2.0/

#pluralistic#chips act#ip#monopolies#antitrust#national security#industrial policy#american economic liberties project#tmsc#leading-edge#intel#mature node#lagging edge#foundries#fabless

254 notes

·

View notes

Note

After having a night to think about it, I don't like the direction this is going with Twilight being Melinda's therapist.

First because Twilight isn't a therapist. He's a spy. He's not trained in therapeutic techniques. I mean, even if he was, he shouldn't be handling the personal friend of his wife, that's a conflict of interest. But Twilight not only isn't a therapist, he has ulterior motives as an agent of WISE.

With his past therapy sessions, like with Anya's teacher, he could give advice with no ulterior motive because WISE didn't care if Anya's teacher has a happy marriage. But WISE has a very vested interest in Melinda and her marriage. How can Loid help her, if WISE is telling Twilight what he needs to do? What if Melinda tells Loid that she and her children are being abused, but WISE decides it's better to keep Melinda with Donovan as a source of information? What if WISE decides it's a better strategy to destabilize Melinda even further?

I think Loid and Sylvia would both want to help an abused mother, but I don't trust WISE's upper management. Melinda is basically a bomb that was dropped into their lap, only it's one that can be easily reprogrammed and lobbed right back into the lion's den.

This story is about war and people who do bad things that they think are right. Twilight having to grapple with seeing an abuse victim in front of him--someone who (just like his mother) is abused by her husband, someone who (JUST LIKE HIS MOTHER) has her own children she is trying to protect--and then being told that he has to manipulate her for his mission. No matter how WISE dresses it up, he will 100% be told to encourage her to stay with Donovan so they can get more info. There's no way they'd let him help her escape.

Twilight would come home to his wife and daughter and have to look Yor in the eye while knowing that her best (maybe only) friend--who Yor TRUSTED him with--is being used and manipulated by him. And even if Anya knows her Papa is a liar, if she peeks into his mind and sees him using a vulnerable Melinda for his organization's benefit... Just like Project Apple was doing to her.

I could see Yor forgiving Twilight for being an enemy spy if he manages to convince her that they're both working towards peace between the countries. But this would be a harder betrayal to swallow, post reveal.

HRGAH. I am gnawing at my arm like a wolf stuck in a bear trap.

I'm not that worried about Twilight not being a certified therapist because he has shown to actually understand his role, so he probably studied and is aware of what he can and cannot say, he might be even better than other therapists considering his observation skills.

Now the fact that Melinda might be used by WISE, now that worries me.

I feel this upcoming situation is gonna be a test of character for Twilight. He might be ordered to use Melinda to help further WISE plans to prevent war, but if he'll follow through is another thing. Hell, he might even help her and when WISE questions why he didn't manipulate her he can bullshit them about how she was too unstable and wouldn't be a trustworthy asset or how since she and Donovan don't even have a close relationship she can't provide anything useful for them. He is their best spy, they trust his judgment since he never put personal feelings before the mission so far.

I think we'll see what Twilight truly wants to fight for. It will be the same situation with Anya in the first chapter. Yeah he could've abandoned her when she got caught and went for another kid, it was the safest thing to do for the mission. But he didn't. Because he wants to protect others.

I trust him in that aspect. He has shown quite a lot of times he is not willing to hurt others for the sake of the mission. He didn't abandon Anya, he protected her from that professor who made her cry, when Donovan talked shit to Damian he subtly but decisively stood by Damian's side, and more recently, he didn't kill Yuri. Even though it was the safest course of action, even though nobody would ever know, he didn't do it.

Because it would make Yor sad.

Because he's here to save others, not hurt them.

So, I bet that he might start thinking about how he can use Melinda, but when he gets to know the state she's at, and how Yor wants to help her, he will come to his senses and do whatever he can for her.

Also, I don't think it is a conflict of interests because she's not family. She is his wife's friend, but since he himself is not her friend, he can still treat her, he just needs to keep both the professional as well as personal sides separated.

18 notes

·

View notes

Text

#hospitality asset management software#hospitality asset management#hotel asset management software#certified hotel asset manager

0 notes

Text

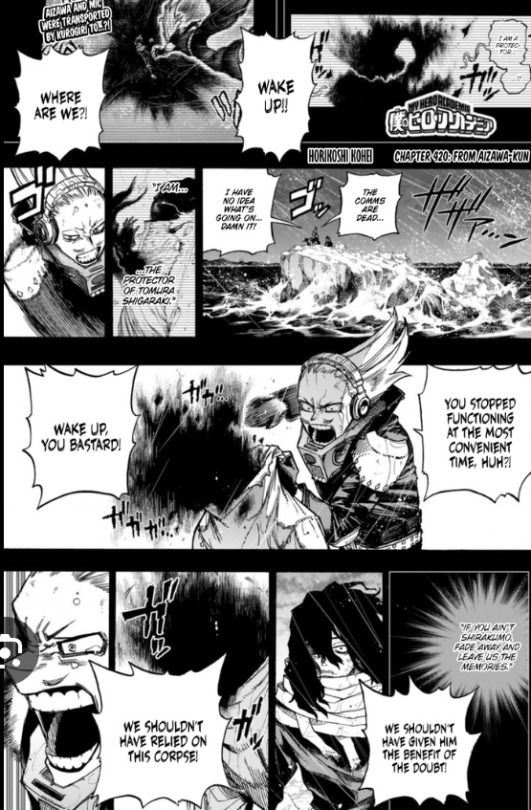

Characters with wasted potential: kurooboro

It's our favourite intelligent nomu kurooboro that deserves so much more attention and a better arc then what he got.

Personally the narrative does seem to treat oboro and kurogiri as two different characters which I like but I wish we got more exploration on that.

Kurogiri

Kurogiri is shigarakis caretaker he is also AFOs servant. However, that's all we know.

1) I would have it that kurogiri used to be a loyal AFO servant. He became a servant/puppet due to him falling through the cracks of the system and trying to escape poverty in anyway he could. Overtime kurogiri got physically sick and his body started to fail yet he still worked for AFO accepting what he did. Afo recognises kurogiri as a valuable asset when his plan of capturing eraser and his quirk goes to mess and starts plotting with the doctor to help kurogiri get a new body which happens to be oboros.

The doctor manages to successfully do this transfer or so he thinks. The doctor is weird and creepy and yes he manages to do implant kurogiri's mind and quirk into a vestige but this comes with some drawbacks like oboro and kurogiri both sharing a mind and body or oboro physically and spiritually rejecting kurogiri making it so that his body is tearing him from the inside out in some way.

Kurogiri is tasked with the job of taking care of Shigaraki and at first he is quite indifferent to the child and doesn't care for him. However, as time goes on he does slowly warm up to shigaraki and care for him ( I love dad kurogiri too much for this). This puts kurogiri in a rough position, he cares for shigaraki but he also hears the plans that AFO and the doctor have in mind for him and he indirectly tries to slow them down or hinder them. All of this is little to no prevail, as much as kurogiri cares he isn't equipped or certified to take care of a traumatised child or to stop afo and the doctors plan.

2)Kurogiri makes a little plan. The plan is one where he gets a bar (AFO allows him) and he basically runs the bar. From the money he gains in the bar he spends some on shigaraki but also hides some of the income to at least assure his and shigarakis own survival. Sadly, the plan is found by AFO himself and the doctor does some "modifications" to kurogiri (practically torture) to keep kurogiri complacent and become the perfect puppet, to play his role. Kurogiri glad that AFO didn't take the bar away from him , but now takes like 50% of the income he earns spends the money on various things. He still has a plan but the initial plan for him to escape with shigaraki is looking slimmer and slimmer. He has a moment where he starts to desire freedom to escape and burn everything he has to the ground to fully forget about shigaraki, AFO, the doctor and all. Yet he stays and finds way to passively retaliate and rebell against both AFO and the doctor.

During this time he and oboro/ oboro's spirit and remains bond over their experiences. Considering that they both want freedom one way or another they work together to enhance their quirk.

Oboro shirakumo

Oboro shirakumo is a former 17 year old hero student who is friends with midnight, present mic and Eraserhead. He was majorly injured during a work study that he did with his friends trying to help save some children.

1) Oboro doesn't actually die, he is just declared dead and taken away. Afo is pretty disappointed when the villain fail to kill/ bring to him Eraserhead and accidentally bring in a heavily injured oboro. The doctor takes oboro, thinking that his quirk has some potential and suggests the idea of making oboro and kurogiri a merger intelligent nomu. AFO agrees to this of course and oboro's body is basically healed/ fixed by the doctor to become a suitable vessel.

2) at this point oboro is in a coma. However, when the doctor tries to merge the two oboro does show signs of retaliation and rejecting kurogiri, yet kurogiri overpowers him. Oboro is scared and untrusting of anyone around him at the moment. Both he and kurogiri get into a lot of arguments over the body they share which proves for it to be difficult to live in the body.

3) due to their differences and background oboro and kurogiri do not get along at first. Oboro is still quite naive about the world but his counterpart kurogiri isn't . Due to their close forced proximity and the fact that both want the body they are in to function they try and cooperate. They get to know eachother and start to understand their respective sides. Kurogiri shares his story, how he had to live on the street and survived of barely anything, how he enjoyed being a bartender before his body started failing him and he had to quit and fully dedicate his life to being AFO's servant. That's when oboro shares his own experiences how he wanted to be a hero, own an agency with his friends and how he also wanted to help others. They continue to cooperate and both make the plan of saving up money and running away from AFO.

3) When that plan is found out and the doctor does his 'modification' oboro goes silent, taking the blunt force of it at the time. This happens for a long while and kurogiri feels alone, this is when he starts to think of just leaving and destroying everything. Oboro is silent, he is stuck in a limbo place. Kurogiri thinks he can see oboro's spirit when he is sleeping but that is neither here or there. However, when they meet Eraserhead in the USJ oboro makes a slow awakening. He physically makes kurogiri's body hesitate and that's what causes them to be stuck in Todorokis ice.

4) Kurogiri is shocked of course and after the battle both of them have a conversation. Oboro isn't aware of how it works and doesn't remember anything after the doctors modifications which is when Kurogiri fills him in about what happened. Both start to work harder than ever for a chance at escaping whether it be them escalating their passive rebellious behaviour to AFO or trying to guide shigaraki to a different path.

They try their best, they really do but looks helpless and their chance at freedom is long and far. That is when they choose to slowly collect information in journals and allow themselves to get captured some time after the overhaul arc revealing their identity.

All of oboro's friends (NOT JUST ERASERHEAD LIKE IN CANON) are conflicted, confused and upset. They comfort eachother and all come into different conclusions, scared but so hopeful for a restoration of normalcy in their lives. It is present mic and eraserhead that try to make the first move, trusting the information that kurogiri provides them and slowly help kurogiri. Present mic is the first to come around at first not believing that its oboro but wanting the information, wanting to know if there is a traitor. Secondly, it's eraserhead out of pure hope and denial, he knows it isn't logical but he misses oboro and hasn't moved on. He now needs to understand that oboro isn't oboro but he is much more complex and has went through things. Lastly, it's midnight with a combination of both factors and guilt. She tries to avoid kurogiri as she blames herself for what happend and also starts to rethink her actions as a hero.

Working with the heroes gets kurogiri out of prison and under UA's custody really but he still is quite ominous especially kurogiri who still wants to save/help shigaraki and ends up talking to izuku about it.

I feel like there are way too many ways we can take kurogiri and oboro's characters in, all with different ways and endings but canon managed to do such a horrendous disservice to him so I hope I have given him some justice

(ALSO HAVE OBORO'S FAMILY BE INVOLVED IN THIS)!! like when people find out that kurogiri is also oboro I don't wanna just see Eraserhead perspective but also midnights, present mic and oboro's relatives

#mha critical#bnha critical#mha#hori is a bad writer#horikoshi critical#bhna critical#bnha#kurogiri deserves better#kurogiri#oboro shirakumo

67 notes

·

View notes

Text

Secure Your Future with Digital Asset Investments

DAIM is a premier provider of digital asset investment services, offering unparalleled expertise and strategic guidance to clients seeking to capitalize on the opportunities presented by cryptocurrencies and other digital assets. With a track record of success and a commitment to excellence, DAIM has established itself as a trusted partner for investors looking to navigate the dynamic landscape of digital asset investment. Our team of experienced professionals combines in-depth market knowledge with a disciplined investment approach to create tailored strategies that maximize returns while managing risk. Whether you are a seasoned investor or new to the world of digital assets, DAIM is dedicated to helping you achieve your investment goals and secure your financial future. Partner with us today and experience the benefits of trusted and reliable digital asset investment services.

#Digital Asset Investments#registered crypto advisor#crypto advisor#best solo 401k#certified crypto advisor#digital asset management#crypto 401k#solo roth 401k#crypto ira#crypto financial advisor#crypto roth ira

0 notes